Drivers need to understand their auto insurance to ensure they have the coverage they need. One of the questions we get the most from drivers is, What’s the difference between liability insurance and collision coverage?

To help answer that question, here’s an overview of liability insurance and collision insurance. For more questions or to get a free car insurance quote, contact GoAuto Insurance.

What Is Liability Insurance Coverage?

Liability insurance covers damage to individuals besides the policyholder after an accident caused by the policyholder. Liability coverage pays for things like:

- Damage to other drivers’ cars

- Medical expenses for injuries of other drivers, passengers, or pedestrians

- Property damage caused by the accident

Most states require some amount of liability insurance. Liability insurance requirements are written as three numbers and are referred to as split limits.

For example, liability insurance requirements are usually written like this: 25/50/25. Here’s what split limits mean:

- The first number refers to the bodily injury limit per person in a claim. In the example above, this means the insurance policy will pay up to $25,000 per person to cover bodily injury.

- The second number refers to the bodily injury limit for the entire claim. In the example above, the policy would pay a total of $50,000 in bodily injury for the accident.

- The third number refers to the property damage limit for the entire claim. In the above example, the policy would pay $25,000 for damage to other vehicles or property.

The most common minimum limits for liability insurance are 25/50/25, but each state has its own state requirements for liability coverage. Drivers need to know their state requirements when purchasing car insurance.

What Is Collision Insurance?

Collision insurance pays for damage to the policyholder’s vehicle after a car accident. A collision policy will cover damage to the policyholder’s vehicle regardless of who was at fault in the accident.

Even if another driver’s policy will ultimately cover repairs, collision insurance allows drivers to timely make repairs to their vehicles without having to wait for the at-fault driver’s insurance to pay for repairs.

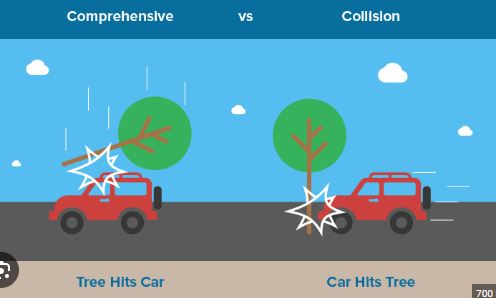

Collision insurance only covers damage to a vehicle after a collision with another car or another object. It’s important to note that collision coverage does not cover damage caused by events other than accidents. Comprehensive coverage is needed for damage from natural disasters, theft, or vandalism.

Collision coverage does NOT cover damage caused by:

- Hail

- A tree limb falling

- Wildfires

- Theft

- Vandalism

- A collision with a deer

While state laws do not require collision insurance, most lenders do. Collision insurance is usually required for drivers with a car loan or leasing their vehicle.

What Are the Differences Between Liability Insurance and Collision Insurance

The biggest difference between liability insurance and collision insurance is who it protects. Liability insurance covers damage to people besides the policyholder. In contrast, collision insurance covers repairs to the policyholder’s car.

Liability insurance is also broader and covers vehicle repair, medical expenses, and property damage. Collision insurance only covers damage to the policyholder’s vehicle.

In addition, liability insurance is required in most states, while collision coverage is optional for many drivers.

Finally, there is no deductible for liability insurance. There is a deductible for collision coverage and it generally ranges from $100 to $1000.

Contact GoAuto for a Personalized Quote

To learn more about the car insurance coverage you need, contact GoAuto Insurance. Our team works directly with drivers to create a personalized quote. We’ll look at your state requirements, lender requirements, and unique needs to create a plan just for you.

We offer affordable coverage that gives drivers the protection they need. Contact us today to learn more or get a free quote.