One of the questions we get the most from drivers searching for auto insurance is, how are car insurance rates calculated? Each insurance provider has its own methods for coming up with car insurance premiums.

That said, there are some common factors used by most insurance companies to calculate rates. Here’s an overview of those factors and some tips for lowering the price of your car insurance.

To get a free car insurance quote or discuss the coverage you need, contact GoAuto Insurance.

Factors Impacting Car Insurance Rates

Lots of information goes into setting car insurance rates. Here are the most common used by auto insurance companies:

- Your driving record. Generally, a cleaner driving record results in lower insurance premiums. Drivers with a history of accidents or serious traffic violations are seen as a higher risk to insurance companies and will pay more for insurance.

- How much you drive. The more you drive, the higher your risk of being in an accident. Drivers who regularly drive for work or have a long commute will have higher rates than drivers who commute fewer miles. Many companies even offer discounts for low-mileage drivers.

- Where you live. Your location greatly impacts how much you pay for car insurance. Urban drivers tend to pay more than rural drivers because they have an increased risk of theft, accidents, and vandalism. Drivers in areas at increased risk of weather-related claims – for example, wildfires or windstorms, also have higher premiums. Finally, insurance companies consider the cost of repairs and medical coverage in your area. Drivers who live in areas with a higher cost of living pay more for insurance coverage.

- Your age. Statistics indicate that experienced drivers tend to have fewer accidents than those with less experience. As a result, teenagers and people under the age of 25 pay more than older people for car insurance. Usually, people over 55 have the lowest premiums, but around age 75 rates start to rise again.

- Your gender. Traffic data shows that women get in fewer accidents, are involved in fewer DUI accidents, and are involved in fewer serious accidents than men. Because of this, women tend to have slightly lower insurance rates than men.

- The car you drive. The car you drive greatly impacts how much you pay for car insurance. A more valuable car typically costs more to insure due to higher replacement costs. Beyond simply looking at how much your car is worth, insurance companies will consider:

- The likelihood of your type of car getting stolen

- The safety record of your vehicle

- The cost of repairing your vehicle

- The engine size

- Your credit score. Many people aren’t aware that credit score can impact insurance rates, but in most states, insurance companies use them when calculating premiums. Companies use a credit-based insurance score to help predict the likelihood of drivers filing a claim. While this score is not the same as a consumer credit score, it’s based on much of the same data.

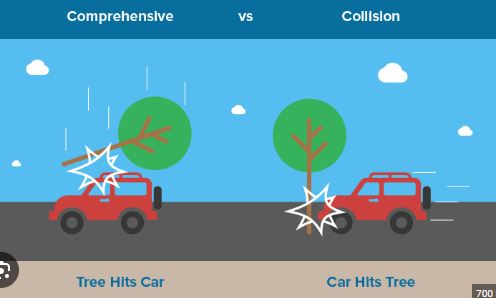

- The type and amount of coverage you need. When buying car insurance, drivers select the coverage they need. Each state has a minimum coverage requirement and most lenders require some amount of minimum coverage. Drivers can select higher policy limits or add-on policies – for example, rental car coverage. The amount and type of coverage selected impact your overall rate.

- Your marital status. Data shows that married people are less likely to file auto insurance claims than single people. Because of this, married couples pay around 5% to 15% less for car insurance than single people.

- The amount of your deductible. The deductible is the amount that you must pay out of pocket when you file an insurance claim. Deductibles generally range from $200 to $2,500. The higher the deductible, the lower your premium will be.

- Your insurance company. Different insurance companies charge different rates for the same coverage. Drivers should compare rates and policies to make sure that they get the best rate on the coverage they need.

Tips for Lowering Your Car Insurance Rates

Drivers want to have the insurance coverage they need with the best rate available. Here are some ways to lower the amount you pay for car insurance:

- Ask about discounts. Many insurance providers offer discounts for things like good grades, safe driving, low mileage, or vehicles with advanced safety features. When shopping for coverage or renewing coverage, ask about available discounts.

- Increase your deductible. Increasing your deductible will help to reduce the amount that you pay for car insurance, but it’s important to not raise it above what you can pay out of pocket for a claim.

- Regularly review your policy to make sure you have the coverage you need. Drivers should be familiar with insurance minimums required by their state and lender. It’s a good idea to review your coverage every year to make sure you’re not paying for more coverage than you need.

- Be a safe driver. Drivers with a clean driving record and no tickets pay less for insurance. Some companies also offer discounts to drivers who use a safe driving app or complete a defensive driving class.

- Shop around and compare rates. Drivers should get quotes from multiple companies to find the best one for them.