Drivers are increasingly asking about temporary or short-term car insurance. Short-term car insurance is a type of auto insurance policy that covers drivers for a limited time.

While most auto insurance companies don’t sell temporary car insurance, there are several ways that drivers can make sure they’re protected even if they don’t drive regularly or own a vehicle.

To help you deal with temporary car insurance needs, here’s a look at when short-term car insurance is necessary and how you can get the coverage you need. Contact GoAuto Insurance with questions or to get a free quote.

What Is Short-Term Car Insurance

Short-term car insurance covers drivers for short periods – daily, weekly, or a few months. A standard car insurance policy is issued for six months or one year. However, there are some circumstances when drivers need coverage for a shorter period.

Some common scenarios when drivers ask about short-term insurance are:

- Borrowing a car

- Renting a car

- Test driving a car

- Putting a vehicle in storage

- Moving

- Traveling

- College students who only drive on breaks

- Drivers who only use a vehicle seasonally

- People who live abroad and only drive temporarily in the United States

How to Get Short-Term Auto Insurance Coverage

Most auto insurance companies don’t offer short-term insurance. You might hear about companies promoting daily or weekly car insurance, but these plans are usually not a good solution. Drivers should be cautious when looking at these plans because they sometimes lack sufficient coverage or may even be scams.

While few insurance companies offer temporary coverage, drivers can affordably get the short-term coverage they need in several ways. Here’s a look at some of the most common solutions for temporary coverage.

Use the Car Owner’s Insurance

If you have permission to drive someone’s car, you’re likely covered by their auto policy. If you are just borrowing the car for a day or a short period, you’re likely covered under the car owner’s policy as long as you have permission to use the vehicle.

Get Added on Someone Else’s Policy

If you’re going to regularly use someone else’s car, it’s a good idea to get added to their policy. Policyholders can add additional people to their policy. However, if an accident occurs, the car owner will still be responsible for the deductible, and their premium could increase.

Buy Non-Owner Insurance

If you regularly rent cars or use a car-share service, consider purchasing non-owner insurance. For those who rent cars infrequently, this option may not be cost-effective. However, if you regularly rent or borrow cars, this can be a good option.

Purchase Rental Car Coverage

If you’re renting a car, your standard car insurance policy might protect you. Review your policy and ask your insurance company to determine whether or not you’re protected.

If it doesn’t cover you and you’re only renting for a short period, you can purchase rental car insurance coverage through the rental car company. This tends to be a pricier option compared to others. That said, it generally does not require a deductible.

While this isn’t the most affordable solution, it’s a good one for drivers who are renting cars for a short period.

Reduce the Amount of Coverage You Have on Your Vehicle

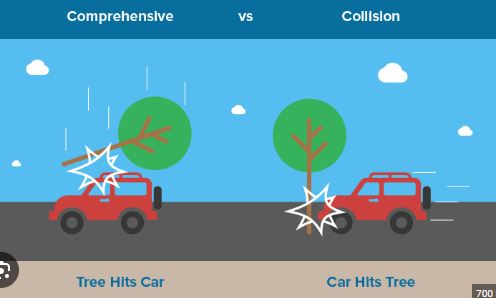

If you’re putting a car in storage, a good solution is reducing your coverage. If you cancel coverage, you won’t be protected from damage caused by vandalism, theft, weather-related events, or something falling on the vehicle.

Rather than canceling, you can suspend your collision coverage while retaining comprehensive coverage, which safeguards your vehicle from non-collision-related damage. This is an affordable way to make sure you’re protected.

Buy a Standard Policy & Cancel When You No Longer Need It

Although standard auto insurance policies are typically issued for six-month or one-year periods, drivers can cancel their policy whenever necessary. This means that if you only need coverage for two months, you can cancel the policy and not have to pay for the remaining four months.

This is a good option for drivers who regularly use their vehicle but know they’ll be selling it, moving, or no longer needing the car in the near future.

Before deciding on this option, check with your insurance company about cancellation fees. Sometimes the fee for canceling can be substantial, which makes this a poor option for drivers.

Purchase a Pay-As-You-Go Auto Policy

Some insurance companies offer pay-as-you-go or pay-per-mile policies. These policies are sold for six-month or one-year terms. With this type of policy, drivers pay a base rate and then an extra charge based on how many miles they drive. It can be a good solution for drivers who need coverage but rarely drive.

Contact GoAuto Insurance for a Free Quote

If you are looking for short-term insurance coverage, the team at GoAuto can help. Contact us today for a free quote.

We’ll listen to your needs and come up with an affordable solution that gives you the coverage you need. We work directly with customers to make sure they have the coverage they need, whatever their situation.