Insurance companies use several factors when calculating auto insurance rates. They gather information on drivers to assess how much of a risk each driver will be to the company. Drivers seen as a higher risk pay more in insurance premiums to compensate for the increased liability they pose to insurance companies.

One factor used to evaluate risk is credit. Most insurance companies review a credit-based insurance score when setting rates. Like a credit score, this number is calculated based on information in a driver’s credit report. Drivers with a higher credit-based insurance score pay less for car insurance than drivers with a lower credit-based insurance score.

After decades of collecting data, insurance companies have found that drivers with lower credit scores file more claims than drivers with higher scores. Further, data shows that claims filed by drivers with bad credit cost more than claims made by drivers with good credit.

Given this data, most insurance companies view drivers with poor credit as a significant liability and an increased risk of filing more claims and more expensive claims.

How to Find Affordable Care Insurance With Bad Credit

Getting car insurance with bad credit can be difficult and expensive. Drivers with poor credit need to be thoughtful when shopping for car insurance to ensure they get adequate coverage at a reasonable rate.

If you have bad credit you should:

- Shop around for auto insurance. Each insurance company has a proprietary method for calculating insurance rates. Companies view risk differently, and some companies weigh credit history more heavily than others do. Drivers with poor credit should get quotes from at least three different companies to find the best deal for them.

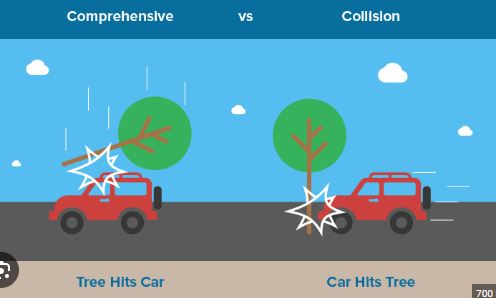

- Select the right coverage. Car insurance policies are not a product where one-size-fits-all. Instead, each driver needs a personalized policy that only provides them with the coverage they need. At a minimum, you need to comply with your state’s and lender’s minimum coverage requirements. If your car is not financed, you’ll have the option of dropping collision and comprehensive coverage. As a general rule, if your vehicle is worth less than $4,000, it usually makes sense to drop at least your collision coverage. When shopping for or renewing auto insurance, review your policy to ensure you have only the coverage you need.

- Increase your deductible. One way to reduce the amount of your premium is to increase the amount of your deductible. Your deductible is the amount you pay out of pocket any time you file a claim. For example, if you file a claim for repairs that cost $5,000 and your deductible is $1,000, you’ll pay $1,000 out of pocket and your insurance company will pay $4,000. Raising your deductible can lower your annual premiums. However, don’t raise it above an amount you can afford to pay if you file a claim.

Tips for Improving Your Credit Score

In addition to finding ways to save on car insurance with poor credit, drivers should work to improve their credit scores. While this might not impact the cost of car insurance in the short term, it will help drivers save in the long term.

Some practical ways to improve your credit score are:

- Consistently making credit card payments on time

- Building a credit history

- Not maxing out your credit cards

- Only applying for credit cards that you need

- Checking your report annually for fraudulent or inaccurate information

Get a Free Auto Insurance Quote

If you’re concerned about how your credit will impact your auto insurance, contact GoAuto Insurance. You can work directly with our team to create a policy that gives you only the coverage you need. We’ve cut out expensive add-ons and commissioned agents so we can provide budget-friendly auto insurance.