When you compare the price of car insurance, it’s important to explore every option so that you’ll get the coverage you need at a price you can afford.

Here are nine tips for getting the best car insurance deals.

1. Shop around

Get a quote from at least three reputable insurance companies so you can compare prices and coverage. Rates will vary from one company to another, and the lowest priced insurance may not give you all the coverage you need. Look at price, amount of coverage, benefits and claims services before you make your decision.

2. Adjust your insurance policy

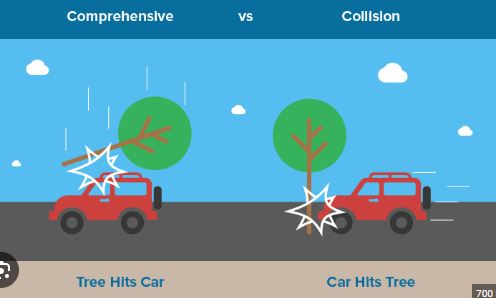

If a company quotes their best car insurance price and it’s slightly outside your range, you may lower it by making small changes. A higher deductible on your vehicle, for example, may lower your rate. Keep in mind though, that if you were to file a claim, your out-of-pocket expenses could increase.

While you’re tweaking your policy, also consider your coverage limits. You may be paying for more coverage than your state requires. Make sure you have the coverage you want, based on your needs.

3. Discount your way to the best auto insurance price

Car insurance discounts lower prices significantly. Remaining accident-free, having an anti-theft device on your vehicle or your teen driver’s good grades could also cut costs.

4. Combine insurance policies

You may save on your auto insurance policy when you insure more than one vehicle. Or by combining your auto insurance policy with other insurance policies, such as homeowners insurance or life insurance you could save by bundling rather than having individual policies.

5. Maintain a good credit rating

Most insurers will figure in the strength of your credit rating when determining the price of your policy. A higher credit score could mean lower rates, so take care to maintain a good rating.

6. Drive carefully

It’s really that simple. If you have at least five years of driving experience and no accidents over the past five years, you may qualify for a safe-driver discount. And with Accident Forgiveness, we won’t raise your auto insurance rates following the first at-fault car accident.

7. Consider car safety features and defensive driving class

You could save money on your car insurance rate if your vehicle is equipped with an anti-theft device, full front-seat airbags or restraint devices that work automatically when your door closes. You may get a defensive driver discount, too, when you successfully complete a motor vehicle accident prevention course approved by your state’s Department of Motor Vehicles.

8. Go paperless

Did you know that Nationwide has several easy ways to automatically pay your insurance bill on a recurring basis? That means you’ll save on postage stamps, help eliminate piles of paperwork, be kind to the environment and avoid late fees. Some policyholders can even get discounts just for signing up for paperless documents.

9. Ask for a regular review of your auto insurance policy

Make sure your policy keeps pace with your life. And you get the discounts you deserve. We recommend you take advantage of a free On Your Side® Review every year, or whenever you’ve had a change in your life.