When comparing quotes, it’s important to make sure you’re getting the same value. Often a policy that has a lower premium may have a higher deductible or less coverage. To get a true one-to-one comparison, review the details of each auto policy carefully to understand what it does—and does not—include. Once you have two policies with the same or very similar coverages, you’ll have an accurate cost comparison.

Common auto coverages

Nationwide offers extensive coverage options that may be available to give you peace of mind when you’re on the road. Customize your policy to get the coverage that fits your life.

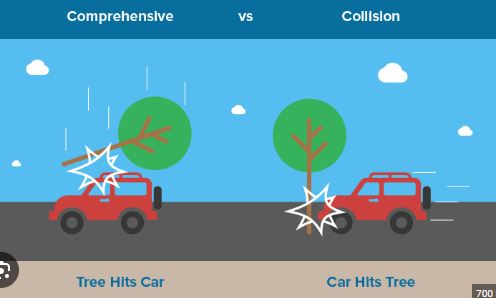

Comprehensive

Also known as “other than collision,” this coverage can help pay for damage to your vehicle from vandalism, theft, weather events and accidents involving animals.

Collision

Regardless of who’s at fault, collision can pay for damage to your vehicle if you hit another vehicle or object, another vehicle hits you, or your vehicle rolls over.

Gap coverage

Gap insurance may help you cover the “gap” between what you owe on your car and your car’s actual cash value.

Uninsured motorist

If an uninsured or underinsured driver causes an accident that results in property damage and/or bodily injury, uninsured motorist coverage may help pay for damage and medical costs for you and your passenger(s).

Bodily injury liability

If you cause an automobile accident that results in injuries, bodily injury protects you by paying for damages you may become legally liable for as a result of the accident, including medical bills and loss of income for the injured party.

Roadside Assistance

Roadside Assistance coverage may even be available when you and your family household members are passengers in someone else’s vehicle, or during a roadside emergency in which your vehicle is disabled.