Car insurance quotes can be obtained at any time. When your auto insurance policy is due for renewal or if you experience a significant life event such as moving or getting married, we recommend obtaining car insurance quotes. Your current provider may be able to offer a better rate than the one you currently have.

If any of the following circumstances occur, shop for car insurance to compare new rates:

- An individual moves to a new zip code

- when you get married

- as you move in with family and can combine your policies

- as you turn a year older

- your credit score increases

- as you begin a new job and drive less

- you have not been involved in an accident or committed a moving violation in three years

28% of our 2022 car insurance survey respondents indicated that they shopped less frequently than once a year, whereas over 26% stated they shopped every six months.

Price comparison tool

Using a free price comparison tool such as the one below, you can compare quotes from major insurers such as Geico, Progressive, and State Farm. You will be required to enter certain information regarding your vehicle and situation.

Factors that increase and decrease insurance rates

Insurers base their rates on the likelihood that they will have to pay out claims on your behalf. You will have to pay more for insurance if you represent more risk to the company and vice versa.

The following factors are considered when determining auto insurance quotes:

- Age, gender, and marital status: Teenagers and men under the age of 25 pay the highest rates for car insurance. Married drivers usually pay less for their insurance than single drivers.

- Vehicle: Your insurance rates are affected by your vehicle’s make, model, and age. Your insurance rate may increase if your car has higher repair costs or lower safety ratings. Stolen cars are more common than others. According to Insurify, full-size pickups, Honda Civics, and Honda Accords all have high theft rates.

- Driving history: Clean driving records can lower auto insurance rates, whereas at-fault accidents, moving violations, and DUI convictions can increase your rates. The higher your points, the higher your rates.

- How much you drive: You can qualify for low-mileage discounts from some insurance companies if you drive fewer than a few thousand miles per year.

- Credit history: When setting your car insurance rates, most insurance companies consider your credit history. Lower credit scores can result in higher rates.

- Zipcode: There is a higher incidence of theft, vandalism, and automobile accidents.

- State requirements: Every state requires drivers to have a minimum amount of coverage, which varies from state to state.

- Coverage levels and deductible: A higher deductible will lower your insurance premiums if you choose higher coverage limits.

Average car insurance quotes

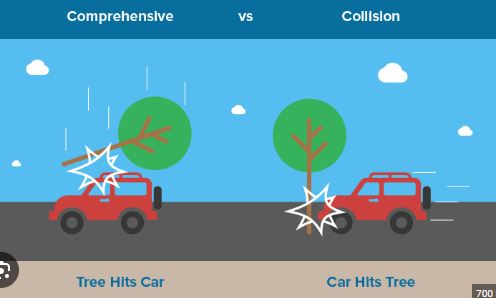

A 35-year-old driver with good credit and a good driving record pay approximately $1,732 annually for full coverage (liability, comprehensive, and collision insurance). Because your location affects your rates, the cost of car insurance can vary widely from state to state.

Average rate estimates by the company

Auto insurance costs vary widely among providers, so it is essential to obtain quotes from multiple companies and compare them. Below are 11 popular insurance companies with their estimated average annual rates. According to these estimates, 35-year-old drivers with good credit and driving records are eligible for full coverage insurance.

| Car Insurance Provider | Average Monthly Rate Estimate | Average Annual Rate Estimate |

| USAA | $84 | $1,013 |

| Erie Insurance | $93 | $1,113 |

| Auto-Owners Insurance | $102 | $1,229 |

| State Farm | $111 | $1,339 |

| Geico | $113 | $1,352 |

| Progressive | $116 | $1,397 |

| Nationwide | $128 | $1,533 |

| Travelers | $135 | $1,617 |

| Farmers | $169 | $2,032 |

| The Hartford | $180 | $2,166 |

| Allstate | $202 | $2,430 |

How to keep car insurance rates low

Even though you cannot control every factor that affects your car insurance quotes, there are a few things you can do to lower your rates. To keep your car insurance premiums low, you can improve your driving habits and credit score, look for discounts, and consider usage-based insurance.

-

- Improve your driving habits. Over time, avoiding speeding tickets and at-fault accidents will prove beneficial. Most leading insurance companies offer a usage-based safe driving program. Those confident in their driving abilities should enroll in Progressive’s Snapshot® or State Farm’s Drive Safe & SaveTM. Telematics insurance programs may increase your premium if you demonstrate poor driving behavior, so be careful.

- Improve your credit score. You will be able to obtain cheaper auto insurance quotes if you demonstrate your financial responsibility.

- Look for car insurance discounts. You are likely to save money if you insure more than one vehicle or combine your homeowners and auto policies. In addition to offering discounts for things such as being a new driver or having an excellent academic record, many companies offer discounts for taking a defensive driving course and having a clean driving record.

- Try pay-per-mile car insurance. In the event that you do not drive very often, pay-per-mile insurance, such as Metromile, maybe the best option for you. Your car insurance rates are based on your mileage. Pay-per-mile insurance typically consists of a monthly base rate plus a charge per mile driven.

When you receive auto insurance quotes from only one provider, even if you use all of these tips, you may still pay too much for coverage. Comparison of options is the only way to determine if a company offers you the best rate.

Recommendations for car insurance quotes

To find the right coverage and price, you should shop for auto insurance quotes from several companies. As soon as you know what you are looking for, you can determine which company offers the coverage type and additional benefits you require.

| Top 10 Car Insurance Companies | Overall Rating | Cost Rating |

| #1 USAA | 9.5 | 10.0 |

| #2 Geico | 9.2 | 9.4 |

| #3 State Farm | 9.2 | 9.0 |

| #4 Progressive | 9.2 | 9.3 |

| #5 Travelers | 9.1 | 8.8 |

| #6 Erie Insurance | 9.0 | 9.9 |

| #7 Liberty Mutual | 8.8 | 8.0 |

| #8 Farmers | 8.7 | 7.9 |

| #9 Auto-Owners Insurance | 8.8 | 9.7 |

| #10 Nationwide | 8.6 | 8.6 |

USAA and Geico are among our top picks for car insurance.

USAA: Low Rates for Military

USAA offers some of the lowest rates for automobile insurance in the industry. Unfortunately, coverage is limited to military members, veterans, and their dependents.